What You Need to Know: Queensland Government Increases First Homeowner Concession Thresholds

In a recent announcement, the Queensland Government has unveiled significant changes to the first homeowner concession thresholds, aimed at alleviating the challenges faced by new homeowners. These updates come amidst rising house prices and growing concerns about affordability in the Queensland property market. In this blog, Synergy Mortgage Brokers outlines what these updated concessions mean to Queenslander’s looking to buy their first home, or build.

The first homeowner concession on transfer duty has been increased from $500,000 to $700,000, with a gradual phase-out up to values of $800,000. Additionally, the first home vacant land concession threshold has been raised from $250,000 to $350,000, also with a phased reduction up to values of $500,000.

This substantial increase is expected to support around 10,000 Queensland based home buyers or builders each. By targeting segments of the market where affordability challenges are most pronounced, the government aims to make first home ownership more attainable for an array of circumstances.

With the recent announcement, Premier Steven Miles emphasised the government's commitment to providing opportunities for young Queenslanders to own their own homes, stating, "I want young Queenslanders to have more opportunity than their parents, including the opportunity to own their own place."

Deputy Premier and Treasurer Cameron Dick also highlighted the decision's role in easing the burden on aspiring homeowners amid rising house prices.

While our Synergy Mortgage Brokers Director, Brendan Philp commended the Queensland Government's proactive steps in supporting first home buyers, "These changes represent a significant opportunity for first homebuyers.”

"By increasing the eligibility thresholds and providing additional support, the government is allowing more Queenslanders to achieve homeownership.”

These changes represent a significant step towards improving housing affordability enabling more Queenslanders to enter the property market. With increased support for first home buyers and strategic measures to offset demand, the Queensland Government aims to foster intergenerational prosperity and provide greater access to homeownership opportunities for all Queenslanders.

Read more about eligibility for a first home concession First home concession – Queensland Revenue Office (qro.qld.gov.au)

First Home Owners Grant

The Queensland Government recently doubled the First Home Owner Grant from $15,000 to $30,000 from November 2023 to June 2025. Read about eligibility criteria here: https://qro.qld.gov.au/property-concessions-grants/first-home-grant/

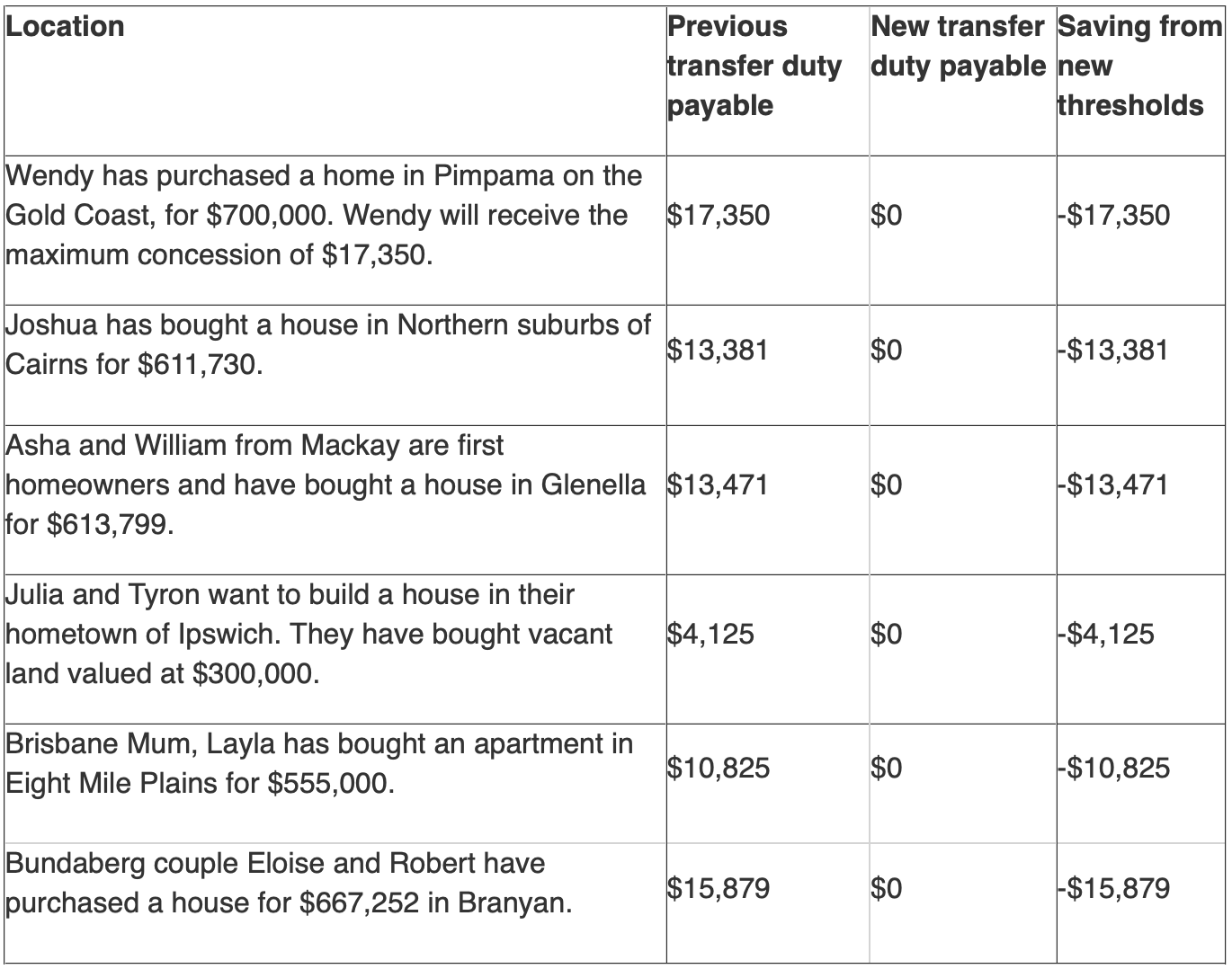

COST SAVINGS FOR QUEENSLANDERS – EXAMPLES

*All eligible first home buyers across Queensland could be eligible for up to a maximum first home concession of up to $17,350, which applies at a property value of $700,000. Examples of the value of concession applicable at different property values below are based on examples of median or indicative property values in various regions across the state.

Subscribe Today!

Stay in the loop - subscribe to our newsletter for the latest trends and insights.

Contact Us Today

We’d love to hear from you. Choose the most convenient method and we’ll get back to you as soon as we can.